uber eats tax calculator nz

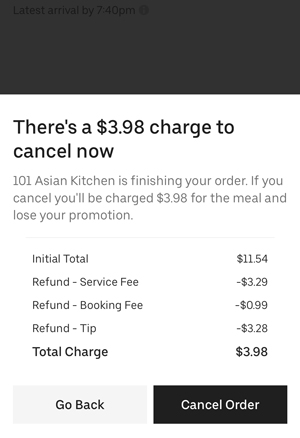

I cant easily calculate my usage as I check my Uber apps daily but only work casually when I feel like it. If you are owed a 700 refund but owe 1000 for Uber then you just owe 300 at the end.

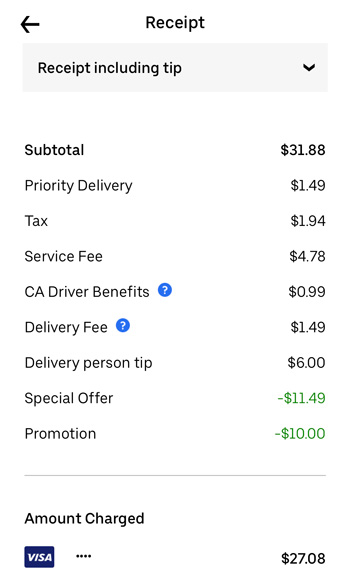

Is Uber Eats Too Expensive How Much Are They Actually Taxing Me On Top Of The Food Order Price Quora

Your total earnings eg.

. 10000 20000 5 or 50. This includes revenue you make on Uber rides Uber Eats and any other sources of business income. TurboTax Self-Employed will ask you simple questions about your life and help you fill out all the right forms.

Your Tax Summary document includes helpful information such as. All you need is the following information. You may also have to pay goods and services tax GST on your ride-sharing income.

This Uber Eats tax calculator focuses on Uber Eats earnings. Rideshare accounting and tax advice and guide to New Zealand rideshare driving for companies like UberZoomyOlaUber Eats etc. Uber NZs tax and costs Uber New Zealand Technologies incurred costs of 976287 resulting in a pre-tax profit of 33561.

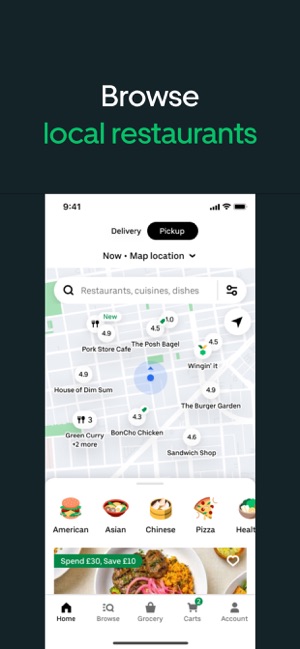

Order food online or in the Uber Eats app and support local restaurants. Order online from top Fast food restaurants in Hamilton. On average a typical Uber Eats driver can make 15 or more per hour.

Get it fast with your Uber account. Perfect for independent contractors and small businesses. According to financial accounts filed with the New Zealand Companies office Uber declared gross revenues of 1061018 in New Zealand in 2014 but paid just 9397 in income tax.

Phone is monthly 110 total. I recieved summary from Uber I am still confusing with about fare breakdown 8000 and potential deduction uber service fee 3000 how much should I put on my tax declaration 5000 or 8000 with 3000 deduction. Your employer pays the other half.

Surge prices in Masterton cannot be shown above as they fluctuate in a matter of minutes. Uber pays weekly which is great for you spreadsheet. If your turnover is under 60000 you may register for GST voluntarily.

There is a lot of confusion around GST registration for Uber drivers. Uber Drivers Lyft drivers and other rideshare drivers. Do I just divide by 4 to get weekly.

This article is not meant to completely explain taxes for Uber Eats drivers. The average number of hours you drive per week. I am doing uber eats and need to lodge my tax.

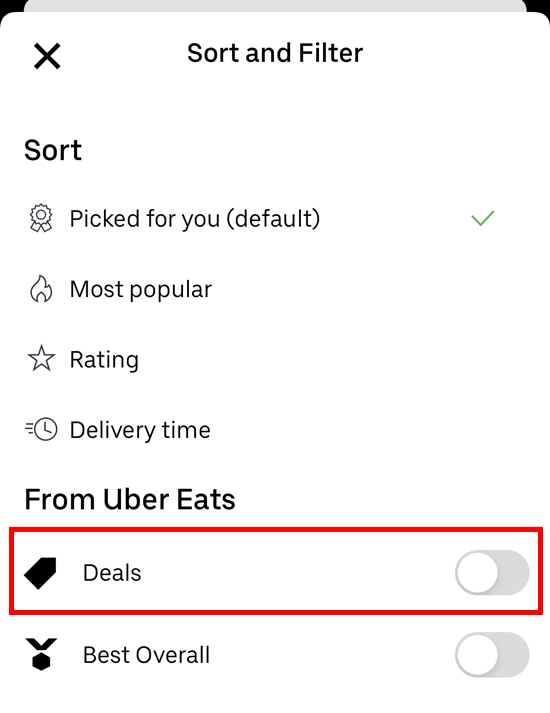

Using Uber as an example your total or gross revenueturnover will be the fares that the customers pay standard fares surge cancellation fees waiting time booking fees airport tolls. According to the IRD you must register for GST if you carry out a taxable activity and your turnover was 60000 or more in the last 12 months or will be 60000 or more in the next 12 months. Find the best restaurants that deliver.

Prices were updated 44 days ago. Sign In Email or mobile number. So you pay 153 of this so called self employment tax.

Remember you will make more money depending on the time and the days you choose to deliver food. It will only help if you increase your deductions on your W-2. In the US Uber claimed driver partners could make between 70000 and 90000 pa but the average income appears to be closer to 15 to 25 per hour.

Get contactless delivery for restaurant takeaway groceries and more. Someone on the. Fees paid to you when you provide personal services are taxable income.

While it paid 9397 in tax based on the company tax rate of 28 percent its total tax bill for 2014 was 33910 due to deferred tax incurred in 2013 its first year of operation in New Zealand. However you can check real-time surges for a specific route using our calculator. Can claim certain expenses as income tax.

As a self employed person you pay both halves. The city and state where you drive for work. So if your deduction is 1 now increase it to 2 3 or more depending on how much you want the.

Uber also issues quarterly statements which dont line up with the above. Your total business miles are 10000. You use the car to transport the passenger for a fare.

You can find tax information on your Uber profilewell provide you with an annual Tax Summary on 3 May 2022. Must declare all income you receive in your tax return. Where to find your tax information.

Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters. However much of this is similar for other gigs like. Income tax and GST.

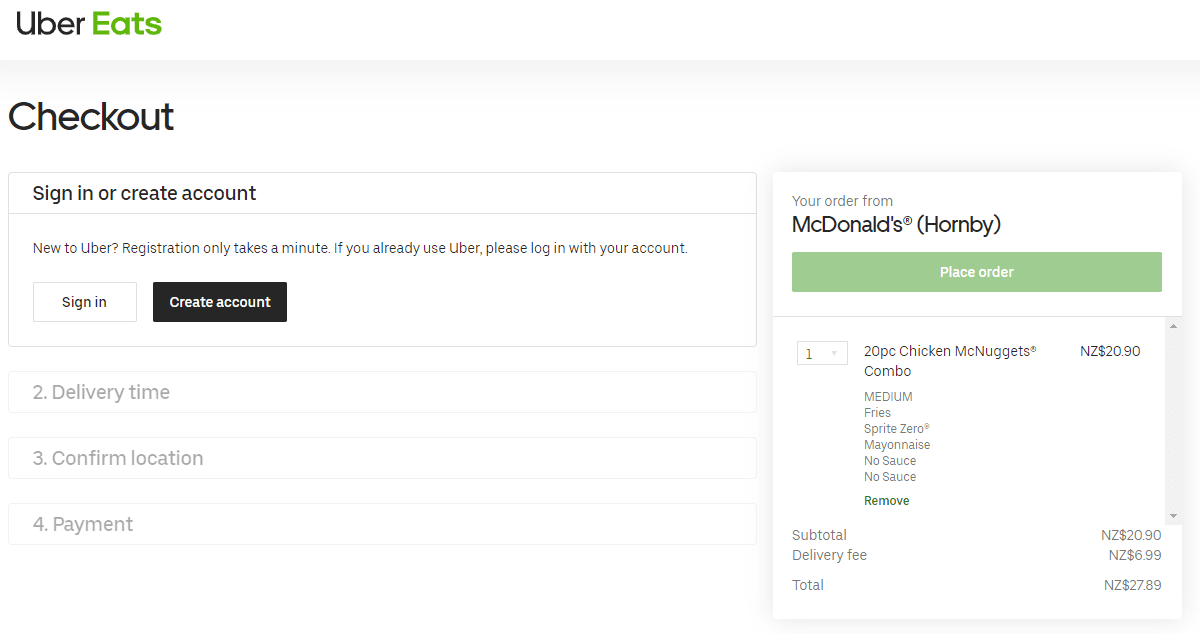

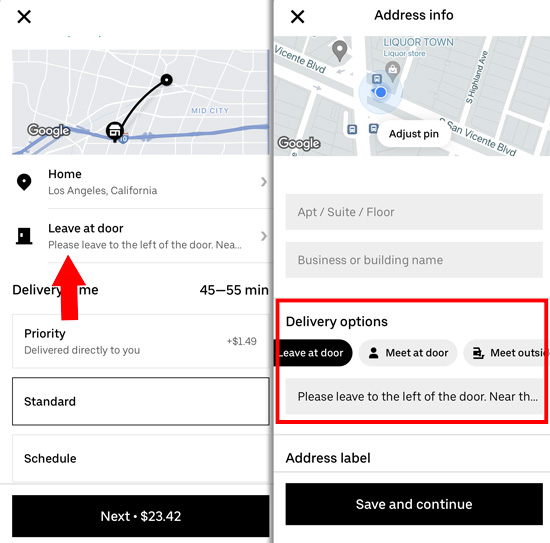

Using our Uber driver tax calculator is easy. A passenger uses a third-party digital platform such as a website or an app to request a ride for example Uber Zoomy or Ola. Dont have an account.

Your average number of rides per hour. You may also have to pay goods and services tax GST. Craving Fast food delivery.

If you want to get extra fancy you can use advanced filters which will allow you to input. For income tax you must. Ride-sharing fares paid to you are taxable income.

Then you also pay income tax just like an employee but only on 80 of your profits if you make over 12k. Click on Tax Summary Select the relevant statement. Vincentrideshareconsultantsconz 09 217 3486.

Average Uber Eats Pay Per Hour. You make estimated quarterly payments without needing any documents from Uber. Because I actually only earn 5000.

Update prices to see the real-time rates with Uber taxi in Masterton. Tax returns for taxi and courier drivers. Average income for Uber drivers will vary on the circumstances of each driver but an average income of 25 to 35 per hour after Uber takes its cut is about average.

5000 x 5 2500 which is the amount you can claim. The amount of money an Uber Eats driver makes per hour greatly depends on the city theyre serving. As an independent provider of transportation services you will be responsible for your own taxes when driving for rideshare companies.

How is this handled. Being a food delivery driver for other gigs like Doordash Grubhub Instacart etc. If youre providing your time labour or services through a digital platform for a fee you.

Uber Eats Food Delivery On The App Store

Free Uber Tax Accounting Software Instabooks Au

How To Become An Uber Driver Or Deliverer Save The Student

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

How To Become An Uber Eats Driver Thestreet

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

Uber Eats Food Delivery On The App Store

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

Marriott Bonvoy 1 000 Bonus Points For Linking Account With Uber One Transaction By March 20 2022 Loyaltylobby

New User Uber Eats Promo Code Hot Sale 50 Off Www Hcb Cat

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

Is Uber Eats Too Expensive How Much Are They Actually Taxing Me On Top Of The Food Order Price Quora

Free Uber Tax Accounting Software Instabooks Au

Does Working On Uber Eats Count As International Student Work Permit Which Is 20hr Week Will Working At Uber Eats Count As More Hours I Heard That It S An Independent Job Somewhere So

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver